The Currencies of South Asia are Depreciating: What are the likely impacts?

The Indian Rupee is going through its toughest times since independence. The impacts are also brunt by the Nepalese currency which remains pegged to the Indian Currency since 1994. Even Pakistan’s currency is depreciating post-IMF bailout of 2019. With the worst performing currencies in the entire Asian region, it can be ascertained that some South Asian currencies are getting weaker with respect to the standard US dollar.

Depreciation of currencies is always not a negative phenomenon. In fact, in developing countries with high inflation, this is much more like a natural occurrence. The depreciation of the currency is good unless and until it is not volatile. However, any random and untimely depreciation can hurt the economy. For instance, the World Bank has pointed out that currency depreciation can be good for India provided it is done the right way.

The economy fares well when the high rates of growth are coupled with market-driven rates of exchange. Immediate impacts of growth faltering are often felt by the exchange rates. As the GPD of the South Asian region is projected to contract by 2.7% in 2020 as a direct result of the pandemic, the impacts have been felt by their currencies. This is when we are not aware whether we’ve seen the worst of the storm or is it just the beginning.

Some scholars from South Asia opine that an orderly depreciation in the currencies can increase the exports and competitiveness in these economies. South Asia is highly dependent on domestic demand which amplifies imports leading to outdoing of the improved rate of exports. However, the South Asian Economic Focus Spring Report (2019) questions the assertive role of depreciation for exports. Despite depreciation, the exports saw an average rise of only 3.2% between 2015-18. In the same period, domestic demand grew by 8.4% per and consequently, the imports of the region were higher than the exports to fill the demand and supply gaps.

Globalisation has resulted in multiple factors impacting the currencies and there are various factors involved which lead to the currencies gaining strength or getting weaker. The world economy has been seeing a downwards trajectory in terms of growth as a result of — (i) trade war between US-China and (ii) the incoming of the pandemic.

How have these currencies been performing in recent times?

Sri Lankan and Bangladeshi currencies have fared well compared to other countries throughout Asia. They have been an outlier in the South Asian region outperforming a massive economy, the size of India.

India:- On August 4, 2020, the Indian National Rupee(INR) opened weak at 75.13 against the US dollar at the interbank forex market. The disruptions in the global market and the pandemic have resulted in it losing value. The Nominal Effective Exchange Rate (NEER) reveals that the INR is at its lowest level since November 2018. It has been sharply declining since July 2019, indicating the Indian economy’s reducing competitiveness. The dip in March of 2020 was influenced by the net outflow of foreign portfolio investments from the Indian equity and debt markets. These stood at $15.92 billion in March, against net inflows of $12.7 billion as of February. INR has been one of the first performers in Asia, with the possible exception of South Korean won and the Pakistani rupee. The start of this year saw the currency depreciate 2% against the US dollar. During the same period, there was an appreciation of 6.3% in the Thai baht, 1.5% in the Malaysian ringgit, and 3% gains logged by the Philippines peso against the US dollar. This was an aftereffect of demonetisation and GST, both of which caused a slowdown to India’s growth, which is now being exacerbated by the disruption in economic activity due to the pandemic.

Nepal:- The Nepali Currency reached an all-time low of 122.61 versus the US dollar this April. This was seen as an effect of weakening Indian currency, to which the Nepali currency remains pegged. The INR had reached its lowest of 76.44 against the US dollar as of April 15, 2020. The devaluation of the currency is a major cause of concern for a country like Nepal which imports heavily from other countries. During March of 2020, a month’s period saw the currency to depreciate Rs. 4.54 against the US dollar. This weakening of the currency is likely to create an inflationary pressure on the economy. The country is also likely to lose out while repaying foreign loans, which are paid in US dollars. An appreciation could have been a great opportunity, as money sent by migrant workers would have been valued more. This, however, will not be the case as a number of remitters is expected to decline sharply because of different labour destinations banning the arrival of foreigners, including the Nepali workers.

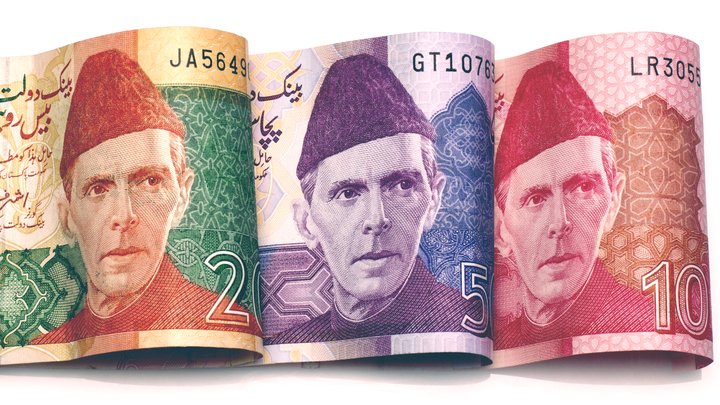

Pakistan:- The Pakistani currency experienced a 3.3% slide against the US dollar between January 20 and May 4 this year. As the pandemic took a better grip in the subcontinent, the currency felt the impact. Within a week from March 2, 2020, the Pakistani Rupee depreciated by more than 2%. This came about as a result of the outflow of foreign funds from risky investment avenues to comparably risk-free markets like the USA. In 2019, the IMF report assessed that from 2019 to the next five years, Pakistani rupee will devalue by RS 78 or 64%. Post-IMF bailout, Pakistani rupee lost its value as the IMF has vouched for a “market-based exchange rate mechanism, which shall see limited intervention by the central bank”. The weakening of the currency is likely to add to the already high inflation in Pakistan. The rupee has weakened by 7.1% till July this year and is likely to further weaken.

The Fitch Solution predicts the Pakistani currency to average weaker at Rs 171.15/USD in 2021 due to due to higher structural inflation vis-à-vis the US.

What would be the likely impacts of the depreciation?

Depreciation is likely to add onto the Current Account Deficit (CAD) which was already rising due to the pandemic. For instance, Pakistan’s CAD soared to $572 million in April 2020. It has seen a 64 fold increase since March of this year when it was around $9 million. This came about as a result of one-fourth decline in exports from $1.82 billion in March to $1.39 billion in April. Even a 5% slowdown in remittances also contributed to the widening of the external deficit. As the imports are likely to become costlier due to constantly falling currencies, the resulting trade deficit will contribute to the widening of CAD. Over this, the exports will also decline this year as indicated by disrupted economic activity and less import of oil. The fall in exports should be a cause of major worry.

Depreciation also poses a risk of inflationary pressures. This risk comes about as a result of rising prices of imports. A study by Goldman Sachs Group points out exchange rate depreciation as a major cause of inflation in South Asian countries, especially India. The analysis points out as to how even administratively controlled prices (such as electricity charges) are impacted by the depreciation of the currency. Other than causing inflation, rising import prices can also impact exports. A lot of export sectors, such as jewellery and automobile, are import-dependent. The rising import prices nullify any advantage that is brought about to exports by the devaluation.

Constant fall in the value of the currency may also lead to a fall in the ratings of these countries. This creates a problem in external borrowing and makes it even costlier. This is problematic considering the countries require funds to fight against the virus and the disruptions it is causing. The rising cost may further even be an inhibition for the industries to borrow which can lead to slower economic growth.

There are also diverging arguments on how the trade war between USA and China is going to play out in the scenario of the devaluation of these currencies. Martin Rama, the Chief Economist for the South Asian region of the World Bank, thinks that devaluation will add to the competitiveness of these currencies in case the trade tensions rise further. Others believe the exact opposite. It has been opined by many experts that exports are likely to be less due to the trade war which impacts the global market. As the pandemic continues and a lot of geopolitics unfolds, more will likely be out to analyse and explore.

Conclusion

The devaluation of the currency affects everyone in this highly populated region. An inflationary pressure along with the declining growth as a result of the pandemic may have an adverse impact on the common man’s pocket. The focus of these economies should be largely on growth as that impacts how these currencies are valued. The investors are moving towards more trusted economies and the central bank’s role will be crucial in such a circumstance. The government and the central banks of these countries will have to work in coordination to get back the investor’s confidence. The central banks need to keep inflation in check so that investors are confident that these currencies will not go into a free fall because ultimately inflation will be in control. The aim of the governments should be to strategically increase the competitiveness of these economies rather than falling for short term approach like devaluation. The exports need to be diversified and a number of countries with whom we trade should not be limited to those in the west. Economic productivity and innovation need to be the ‘mantra’ for the times to come.

References

- “IMPACT OF RUPEE DEPRECIATION ON INDIAN ECONOMY”. 2020. Inventiva.

- “Weakening Nepali Currency To Hit Economy”. 2020. The Himalayan Times.

- “Orderly Depreciation Of Rupee To Increase Competitiveness: World Bank Official”. 2020. The Economic Times.

- “Explained: How COVID-19 Is Hurting The Rupee’S Exchange Rate With Other Currencies”. 2020. The Indian Express.