Virus Puts Economy on Life Support: How Economists Tackle the Health Emergency

India recorded its first case of COVID-19 on January 30. Fast-forwarding to the present date (May 9), the number of cases have reached around 60,000 mark and the doubling rate of the virus is estimated to be 11 days. Amidst the human suffering due to the global viral outbreak, the line between the public and private spending has to be blurred all across the governments of the world as the unprecedented event of this global pandemic is ready to worsen the global economy, it would be a challenge for the largest democracy to mitigate its staggering effect within its boundaries. This article is an attempt to gauge the economic cost of the virus, fiscal measures taken by the Indian government and RBI and the scope for creative solutions to an unprecedented problem. The lockdown that has now been extended consecutively for the 3rd time calls for efficient management of the pandemic as well as the economy and is going to be a tough test for India’s bureaucracy.

The Economic Cost of the Pandemic

The stay at home order issued on March 23, led to a stoppage of economic activities except for the essential services. The generality of the pandemic and the followed lockdown in terms of impact can be seen across sectors.

There have been one of the worst drops in the business activities in the country bringing down the services Purchasing Managers Index (PMI) to 5.4 in April from 49.3 in March (a measure less than 50 is indicative of shrinkage in activity). The service sector contribution towards GDP is more than 50%. Similarly, the manufacturing PMI was also at an all-time low of 27.4 in April. Another sector that is ailing is the MSME, many of the MSME’s are on the verge of a shutdown and are unable to generate revenue to pay its employees leading to large scale layoffs. Tourism and hospitality sectors are also in bad shape as they were one of the first few sectors to get affected due to the global pandemic and probably will be the last to resume services in this time when social distancing and staying home is the only remedy available. The aviation sector has also witnessed layoffs and pay cuts, with a complete ban on travelling and global airlines announcing furlough the strain on the aviation sector is getting worse.

The automobile sector which was forced to stop key manufacturing is in a similar condition. Some of the largest manufacturers have reported zero domestic sales in the month of April, however, some of them were able to export few units to the Chinese and Japanese markets because of opening up of domestic ports.

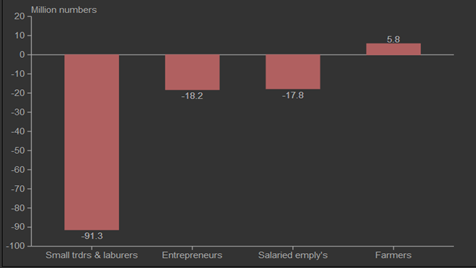

The current data released by Centre for Monitoring Indian Economy (CMIE) has shown a spike in the country’s unemployment rate to 27.11% for the week ended May 3rd around 122 million Indians lost their jobs in the month of April alone. According to CMIE latest data 91.3 million small traders and labourers lost their job, followed by 18.2 million entrepreneurs and a significant no. of salaried workers i.e. 17.8 million have lost their job as shown in the graph below. Agriculture which appears to have dodged the impact isn’t unusual as the workers returning home will be absorbed in the agriculture but that can’t be assumed to be a positive sign as that would only lead to an increase in disguised unemployment.

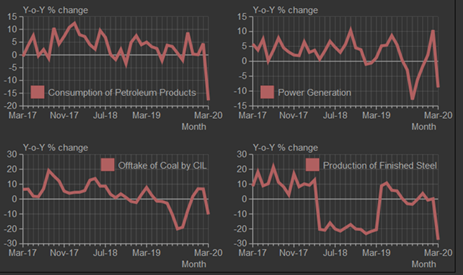

The state-wise division of Red, Orange, Green zone COVID districts, has resulted in the shrinking of activities in most of the important and major cities. A large share of economic activity falls under the red zone, the zone alone comprises of 130 districts that account for 40% of GDP, whereas the 352 green zone districts only comprise of less than a quarter. We also have to keep in mind that these 3 zones can’t function independently of each other for very long thus making the need for a robust and sustainable future planning all the more important. The pandemic has brought the industrial production at a significant low, even the industries that are deemed essential are suffering from low production, as no industry can function in isolation when the global supply chain is disrupted. The production graph of the major essential industries is shown below:

The economic impact of the lockdown has started to show and is becoming prominent with every passing day. In this unprecedented situation, nearly all sectors have demanded intervention in the form of economic packages. There have been several steps taken by the government and the central bank in order to contain this crisis.

Measures by RBI

The Reserve Bank of India has done a commendable job to dampen the effect of the pandemic on the Indian economy. RBI’s decision to maintain high liquidity in the economy to tackle the complete shutdown has been 3 pronged.

First and probably the most important of all the announcements is the “Targeted Long Term Repo Operations”(TLTRO). Since a very long time, there have been attempts to plug the broken transmission mechanism of the monetary policy (a reduction in the repo rate doesn’t lead to a fall in the rate of interest offered by banks to the borrowers). This precisely has been because of two major issues,

- The statutory liquidity ratio (that mandates the banks to hold a certain amount of their funds in government securities, which leads to a fall in funds available for the private sector)1.

- The asset-liability mismatch, the repo rate allows the bank to borrow at low rates for a short term, usually overnight, but the commercial banks generally lend for long term(education loans and personal loans).

This renders monetary policy to be less effective. TLTRO 2.0 allows the banks to borrow at the overnight rates (presently at 4.4%) and lend long term for up to 3 years, simply giving access to cheap loans for commercial banks.

Secondly making lending more fruitful, RBI has reduced the reverse repo rate(the rate at which RBI borrows from commercial banks) to 3.75 which induces the banks to extend credit in the market and not park their money with RBI, to make sure that the credit is provided to the ailing corporate sector and not only to retail borrowers, the RBI has mandated the commercial banks to use the TLTRO funds to invest a predetermined portion in Microfinance institutes and NBFC’s.

Thirdly providing relief to the retail customers through an advisory moratorium on EMI payments, RBI has advised the commercial banks to defer the EMI payments for the time being to reduce the burden on the households and provide extra cash in hand to spend in the market. The recent announcement of winding up of the 6 Franklin Templeton(F.T) Debt fund schemes shed some light on the liquidity issues pertaining to the absence of a complete market for securities. As the pandemic struck, the market sentiments turned negative and the investors rushed to sell off their holdings to minimize losses. All the 6 schemes mentioned above were investing a major portion in bonds and commercial papers that were investment grade but not AAA-rated. As F.T was investing in these funds for the higher returns it offered to the investors, It didn’t have enough cash reserves to pay off investors in case of redemptions. The low cash in hand situation combined with no market to sell off its assets led to the winding up of the schemes. This also created a redemption pressure on other Debt fund schemes as well, RBI tackled this by opening a 50,000 crore ($6.6 Billion) window for commercial banks to borrow at the repo rate and buy securities or assets of the debt fund schemes. Which certainly released some pressure off the funds.

Government Measures

With the private sector seeing a fall in demand, the burden to revive the economy fell on the governments’ shoulders. It has been a common suggestion that the Government expenditure needs to increase significantly, but in this section, we will analyze why it’s not that simple.

Government of India announced a $22.6 billion (approximately 0.8% of GDP) economic stimulus plan that provides direct cash transfers and food security measures, offering relief to millions of poor people hit by a nationwide lockdown. The package was announced two days after Prime Minister ordered the 21-day lockdown to protect the country’s 1.3 billion people from Covid-19. That led to supply constraints for essential items and panic buying, leaving the poor and daily labourers most vulnerable.

The government aims to distribute 5 kilograms of wheat or rice for each person free of cost, with a kilogram of pulses for every low-income family, helping to feed about 800 million poor people. It also intends to hand out free cooking-gas cylinders to 83 million poor families, a one-time cash transfer of $13.31 to 30 million senior citizens and $6.65 a month to about 200 million poor women. The government outlined plans for medical insurance worth 5 million rupees ($66,000) for every front-line health worker, from doctors, nurses and paramedics to those involved in sanitary services.

The package was deemed to be inadequate to help revive an already ailing economy. The Government finds itself in a precarious situation, with the industrial activities on a complete halt the tax revenues have taken a massive hit. Amidst this bloodshed, the first casualty in this war against corona is going to be the Fiscal Responsibility and Budget Management Act (FRBM), that mandates the government to maintain a fiscal deficit of 3% and revenue deficit of 0%. The government already had to take the help of the escape clause for this year’s budget riding on the ‘Structural changes’ in the Corporate income tax.

Fitch Ratings have warned the government that large fiscal packages (some estimate it to be around 2-2.5% of GDP) will lead to a downgrading of the ratings of the sovereign bonds that were already just one notch above junk. This means that as soon as the ratings are downgraded, all the pension funds (that are mandated to invest only in investment-grade bonds) won’t be allowed to invest in Indian sovereign bonds.

IMF has forecasted a negative growth for the Gulf countries, which is bad news for the 10 million Indians residing there. This negative outlook is going to put pressure on India’s foreign exchange reserves as India was the highest recipient of remittances ($86 billion) last year.

All the above-mentioned problems have made government spending difficult.

The state governments are in a similar situation, having been deprived of their share of compensation in the GST, The state governments have taken some extreme steps to financing their own welfare schemes, for example, the government of Delhi increased VAT on petrol and diesel followed by a 70% “corona” cess on liquor.

Our Suggestions

The problem that the government faces is something that has never been experienced before and warrants more creative solutions. The First thing that the government needs to do is defer some of its capital expenditure projects (such as the central vista project) to the next fiscal and divert funds towards the second stimulus package. The government can also explore the option of pledging its PSU undertaking shares to the commercial banks to secure loans. India has 58 PSE with a combined market capitalization of around Rs. 10 lakh crore ($132.3 Billion), The Government can pledge a part of it to RBI. For example, the government can pledge some of its stake in LIC a tenth of which was supposed to be sold off anyway. The loans can be repaid as soon as economic activity resumes and then the equity can be sold off in the market which also takes care of the government’s disinvestment targets. On May 5, RBI Reported a cash deposit of around Rs. 8.5 lakh crore ($112.5 Billion) through the reverse repo window, which means it has the necessary funds to lend to the government. A key benefit for such an agreement is that it can be termed as a repurchase (REPO) agreement and not only would it allow the government to borrow cheaply, it wouldn’t add to the centre’s debt burden and will keep the credit ratings in check.

Amidst the huge chorus for unveiling massive relief packages, the government needs to optimize the use of funds by estimating which segment is most likely to deliver the best returns. As an example, the Automobile sector has been cash-rich so it doesn’t really require massive packages, some bureaucratic support like a delayed shift to Bharat VI norms will allow them some time to sell the existing stocks and get back to the pre-pandemic stage. On the contrary, Existing real estate projects that have taken a hit because of the pandemic needs to be revived because they have the potential to provide more employment. Access to interest-free loans, easier compliance norms can be some steps in the right direction. One sector that has seen a massive investment deficit since the past 70 years is healthcare. Investing more in primary healthcare infrastructure will lead to the revival of the economy and prepare the economy for future catastrophes.

Any kind of catastrophe brings along an opportunity for policy reforms. We believe that the government like the RBI should use the pandemic to push reforms that have been long due.