5 Megaprojects in China’s $1 Trillion Infrastructure Plan

China is pumping trillions of yuan into infrastructure investment, stimulus that could benefit the world’s second-largest economy well beyond this year’s gloom of Covid lockdowns and property market turmoil.

Beijing is making 6.8 trillion yuan (about $1 trillion) of government funds available for construction projects. Total spending could be even higher than that — three times that amount, by some estimates — once bank lending and corporate funds are added.

In the near term, infrastructure investment could give a boost to employment, providing much-needed relief to millions of job seekers hit by the downturn. Over the longer term, the stimulus helps China’s ambition of becoming a more urbanized, high-income economy that’s better able to compete with the US in high-tech areas like semiconductors.

Whether the projects are a success or end up as white elephants will help determine the outlook for China for years to come. Here’s a guide to where the funds are going.

1. Renewables

Deserts in north China are set to host an unparalleled build-up of renewable energy. In recent months, construction began on wind and solar power “bases,” which by 2030 will contain about as much renewable capacity as currently in all of Europe.

The first phase, with about 100 gigawatts of turbines and solar panels, is due to be completed by next year, with another 450 GW phase starting this year.

The second phase will cost more than 3 trillion yuan, according to state media. Ultra-high voltage transmission lines will transport the energy to the densely populated eastern seaboard. China’s state-owned grid company plans to build 13 of them this year.

Combining investment in renewable energy and power transmission, China’s total “green investment” could reach 2.6 trillion yuan this year alone, according to Australia & New Zealand Banking Group.

2. Canals, Dams and Reservoirs

Construction of canals, dams and reservoirs has been stepped up, with more than 800 billion yuan set to be invested in those projects this year.

The most ambitious is a 200-kilometre-long tunnel moving water from the country’s Yangtze river to a reservoir that feeds northern China, a scheme known as the South-North Water Transfer Project. It would be the world’s longest water tunnel, beating the current record holder in Finland, and parts of it would be as deep as 1 km underground.

Projects that move water around the country account for about a third of China’s water infrastructure spending, according to estimates by Wenjing Zhang and Sarah Rogers, researchers at the University of Melbourne. Planned projects could increase the amount of water available for use in China by 122 billion cubic meters annually, they estimate — that’s about five times the amount of water Germany uses each year.

“China has been quietly moving towards a highly integrated water supply network,” the researchers wrote in a recent report. “Such a network will allow the Chinese state to move water around at an unprecedented scale.”

The government also favours the projects because they are highly labour intensive. About 30,000 ongoing water conservation projects employ about 1 million workers, the country’s water ministry has said.

3. Urban Infrastructure: From Concrete Sprawl to Greener Cities

Building urban infrastructure — including urban roads, gas and water pipe networks and parks — is the most popular choice for spending by local governments, which account for the bulk of China’s infrastructure spending.

The latest plan involves linking together existing cities into a single area. For example, a zone approved around the city of Xi’an in March has a current population of 18 million people.

After decades of concrete sprawl, the focus is shifting toward greener cities. Central China’s “Songya Lake Ecological New City,” which began construction this year at an estimated cost of 200 billion yuan, has specified it will leave 70% of the area for green spaces and water. That’s the same ratio of buildings to natural space as in the under-construction city of Xiong’an near Beijing, which planners around the country are taking as a model after it was championed by President Xi Jinping.

The other favoured investment of local governments are industrial parks providing low-cost facilities to businesses. Local governments spent about a third of funds raised from selling bonds on urban infrastructure and industrial parks in the first quarter, according to official data. At that rate, they could spend about 1.4 trillion yuan on such projects this year alone.

A typical example is the 20 billion-yuan Qingdao Integrated Circuit Park in eastern China, started this year in an attempt to support the chip industry, which has become a national priority due to US sanctions.

Success is far from guaranteed though.

4. High-Speed Rail

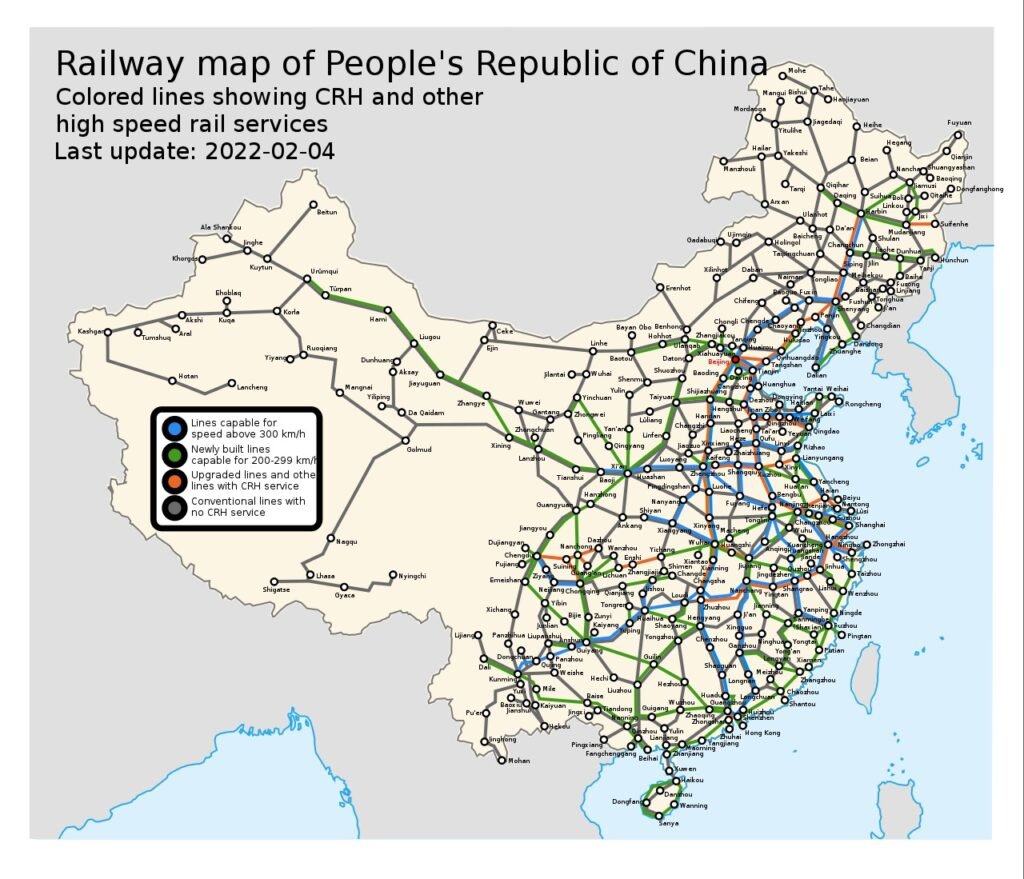

China already has 40,000 km of high-speed rail — more than twice as much as the rest of the planet combined — and dozens of big-ticket projects are still ongoing.

The most ambitious is a 1,629 km line from Sichuan province in the southwest to the Tibetan capital Lhasa, climbing more than 3,000 meters through earthquake-prone terrain and glaciers. It’s expected to be completed by 2030. The total cost of the entire project is about 320 billion yuan.

China said this year it plans to have 70,000 km of high-speed rail by 2035. But that actually implies about a 40% decline in the amount of track built each year compared with the pace set over the past five years. In other words, while China will continue to outspend the rest of the world on rail, its spending could gradually decline.

The same is true for highways and subways. China plans to construct or restore 58,000 km of expressways by 2035, implying a sharp slowdown in the pace of annual building compared with the past five years. One route under construction includes the 1,176 meter-long Changtai Yangtze River Bridge, the world’s longest road and rail suspension bridge.

Chinese cities are still adding underground subway lines at a rapid pace, but national spending peaked in 2020 at 629 billion yuan, according to the China Metro Association.

5. 400 Billion Yuan a Year on Data Centers

As part of an effort to build a more digital economy, China’s “East Data West Computing” plan involves building huge data centres in poorer Western provinces to hold data generated by internet companies based in the east. Building eight data centre clusters will cost about 400 billion yuan a year — most of which will come from state-owned telecom companies.

Credits: World Market Watch/LinkedIn