Analysis: After oil, gas and coal, global fuel shortage spreads to diesel

Global supplies of diesel are dwindling as refiners struggle to keep pace with rapid post-pandemic demand recovery, exacerbating an acute global energy shortage which has already sent the prices of gas, coal and crude oil soaring.

At a time when global central banks are fretting over inflation rates not seen for decades, diesel shortages would push up fuel and transportation costs further and add more upward pressure on retail prices.

The U.S. and Asian diesel imports on which Europe relies have been limited in recent weeks due to higher domestic consumption for manufacturing and road fuel purposes.

Gasoil inventories, which include diesel and heating oil, held in independent storage in Europe’s Amsterdam-Rotterdam-Antwerp (ARA) refining and storage area fell last week by 2.5%, data from Dutch consultancy Insights Global showed.

Regional stocks were at their lowest level for this time of year since 2008, according to the data, while Singapore’s onshore inventories of middle distillates also sank to multi-year lows of 8.21 million barrels.

“Diesel demand seems to be improving in (northwest Europe) but lower refining capacity compared with pre-COVID and low import levels are keeping the market under severe pressure,” said Insights Global’s Lars van Wageningen.

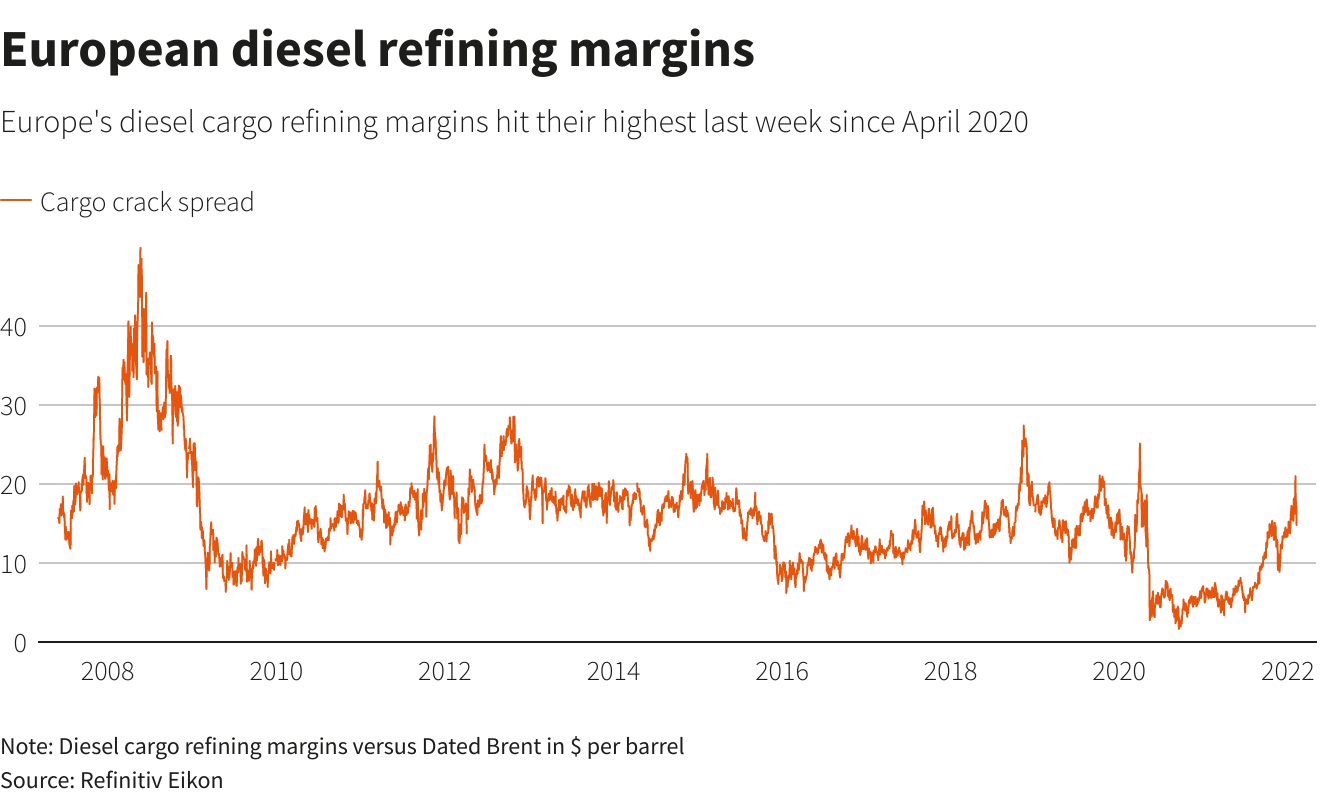

Northwest European diesel cargo prices reached $114/bbl on Monday, the highest since September 2014, while margins to crude reached two-year highs last week.

Morgan Stanley analysts note that diesel prices reached around $180 a barrel in 2008, driven by an “exceedingly tight” middle distillate market as Brent crude rose close to $150/bbl.

“A repeat of that is not our base case, but it is notable that diesel prices have been tracking the 2007-08 period closely in recent months,” they said, adding that they expected crude prices to reach $100/bbl in the second half of this year.

Last week, a winter storm tested fuel availability in the U.S. with some utilities preparing to use more distillate fuel oil to meet demand, while South Korea and India have been unable to fill a supply gap left by China’s recent clampdown on refined product exports due to their own domestic needs.

Tight supply has pushed Asian diesel prices for the benchmark 10ppm gasoil to their highest since Sept. 2014.

Refiners generally respond to high margins and low inventories by ramping up output. But the global oil refining complex is under strain, with capacity falling for the first time in 30 years last year as closures outweighed new additions, the International Energy Agency said last month.

Increasing diesel output would also require faster than normal crude processing rates at refineries, with downstream equipment configured to maximise middle distillate yields at the expense of light ones.

Instead, a number of refineries – particularly in the U.S. – are still running plants at rates below the five-year average to avoid producing too much jet fuel, where demand still lags 2019 levels, leaving companies struggling to identify a clear way to restock diesel inventories in the short term.

“Given the pressure from investors to reduce investments in fossil fuels and talk of peak oil demand, this backdrop likely reduces the incentive to invest in new refining capacity,” UBS analyst Giovanni Staunovo said.

“With fuel demand likely to increase in the next 10–15 years, and supply unable to keep pace, I would expect more (fuel price) volatility in the future,” he added.

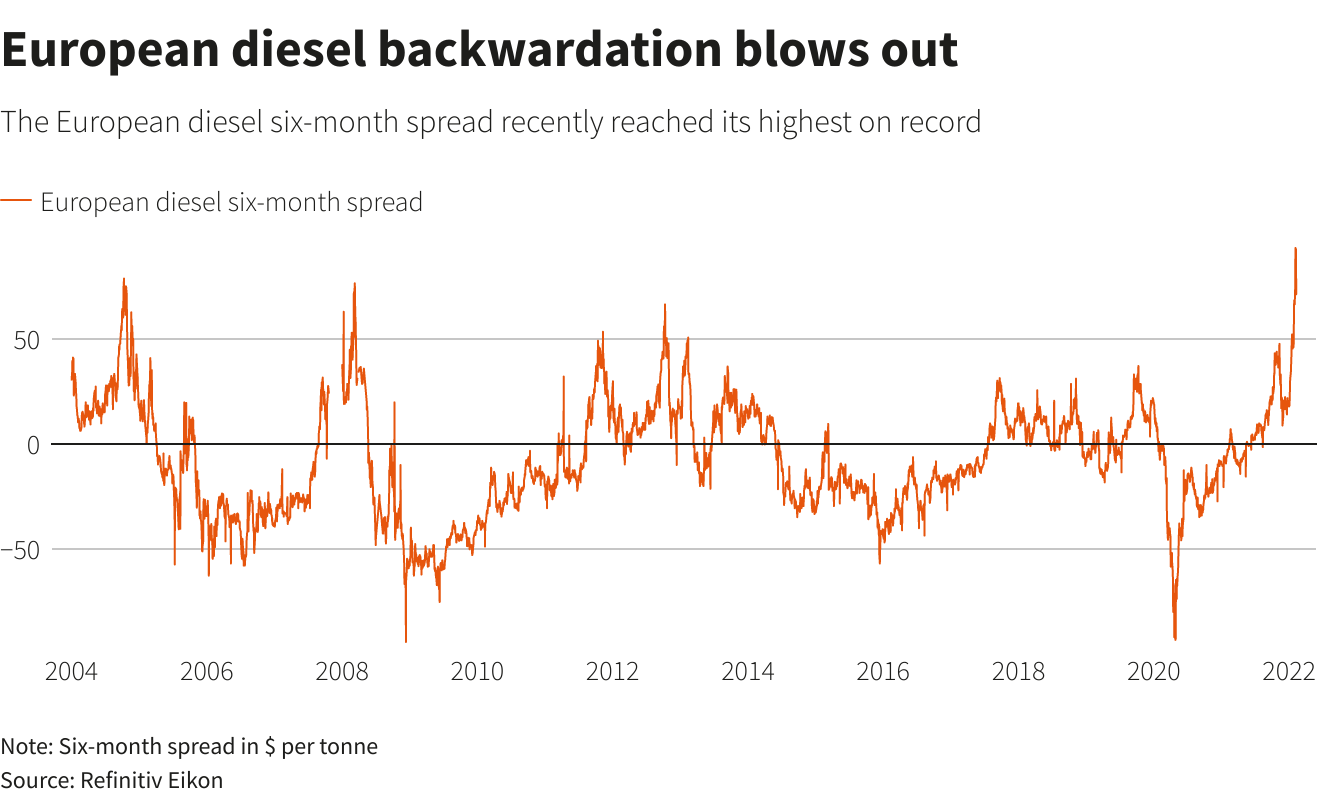

Leaning backwards

Tightening European supplies pushed the region’s six-month diesel spread to more than $100 a tonne on Monday, its widest backwardation on record.

Backwardation means that prompt prices are higher than future contract prices, reflecting near-term demand that encourages traders to release oil from storage to sell it.

Nonetheless, preliminary diesel and gasoil flows into Europe from east of Suez, Russia, the Baltics and the U.S. this month are currently at 1.66 million tonnes, revised down from previous expectations of 1.83 million tonnes, according to Refinitiv data, and compared to 4.6 million tonnes in January.

“We have seen minimal diesel exporting from the U.S. Gulf Coast, and zero storage plays on clean vessels,” said one U.S. clean tanker broker.

Reporting by Rowena Edwards, additional reporting by Ron Bousso in London, Laura Sanicola in New York and Mohi Narayan in New Delhi; Editing by Kirsten Donovan