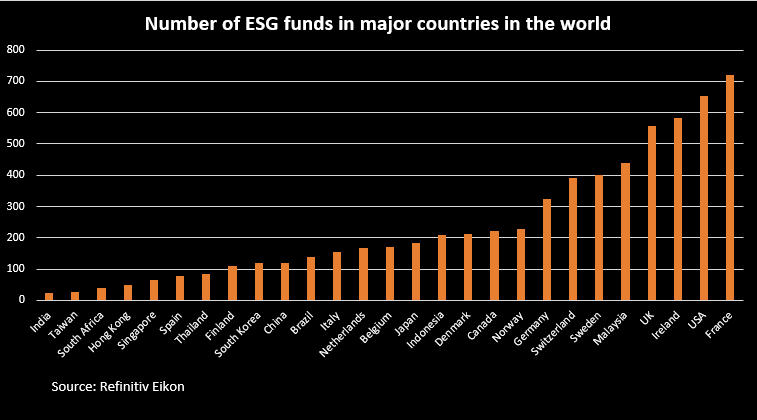

India has fewer ESG funds than other top 10 economies

India has fewer funds focused on environmental, social and governance (ESG) issues than other top 10 economies, data shows, amid investor caution about ESG funds that have yet to build a track record in India’s market.

The world’s sixth largest economy has 23 ESG funds, Refinitiv data shows, compared to the United States and Britain with more than 500 each, while Japan has 182 and China has 119. Other economies in the top 10 also have more ESG funds.

“Indian investors are not completely attuned to the concept of sustainable investing, unlike global markets led by Europe, where sustainable investing has been present for many years,” said Kaustubh Belapurkar, director at Morningstar India.

Analysts said investors were reluctant to put cash into ESG funds as most funds in the sector were new and could not show a track record of outperformance.

“Institutional investors and distribution partners often have policies in place that do not allow them to invest in funds which are less than three, or in some cases five, years in the market,” said Chaitanya Kalia, a partner at EY India.

“The idea is to track the performance and consistency before investing,” Kalia said.

Indian ESG funds have faced outflows in 12 of the last 14 months, Morningstar data shows. In contrast, inflows into equity mutual funds hit a record high of 225.83 billion rupees ($3.04 billion) in July, the Association of Mutual Funds data shows.

Institutional participation was driving money into ESG funds in Western markets, said Dhirendra Kumar, founder and chief executive of Value Research.

“When you have a committee which states and passes a resolution, they will have to invest the money,” he said. “In India, it is led by retail investors. And retail investors chase recent performance.”

Lipper data shows Indian ESG funds have risen 19% on average this year, in line with overall equity funds.

The Securities and Exchange Board of India (SEBI) announced new disclosure norms based on ESG parameters for the top 1,000 listed companies by market cap in May.

Those rules, effective from the financial year starting in March, aim to help investors look beyond a company’s financials and gauge its social and environmental impact.

“More transparency on ESG performance will support the growth of ESG funds,” said EY India’s Kalia. “There is a great possibility we will see more ESG funds coming into picture in the next two to three years.”

Reporting By Patturaja Murugaboopathy, Gaurav Dogra and Abhirup Roy in Mumbai Editing by Vidya Ranganathan